THEIR LIVES

YOUR LEGACY

PLANNED GIVING

When you make a planned gift to the Cheyenne Animal Shelter Foundation, you play an instrumental role in the future of Laramie County’s people, pets, and community. Your investment in the long-term health of the Cheyenne Animal Shelter through a planned gift to the Foundation makes a lasting difference in the lives of countless homeless, neglected, and abused animals for years to come.

Wills or Trusts

Include a gift of cash, securities, real estate, or personal property to the Cheyenne Animal Shelter Foundation in your will or trust. This gift can be designated as a fixed amount, specific assets, a percentage of your estate, or all or a portion of the residue of your estate.

Stocks, Bonds, or Mutual Funds

Transfer appreciated stocks, bonds, or mutual fund shares you have owned for more than one year to the Cheyenne Animal Shelter Foundation. Donating appreciated stock may be more beneficial than giving cash. The "cost" of your gift is often less than the deduction you'll receive by making this generous donation.

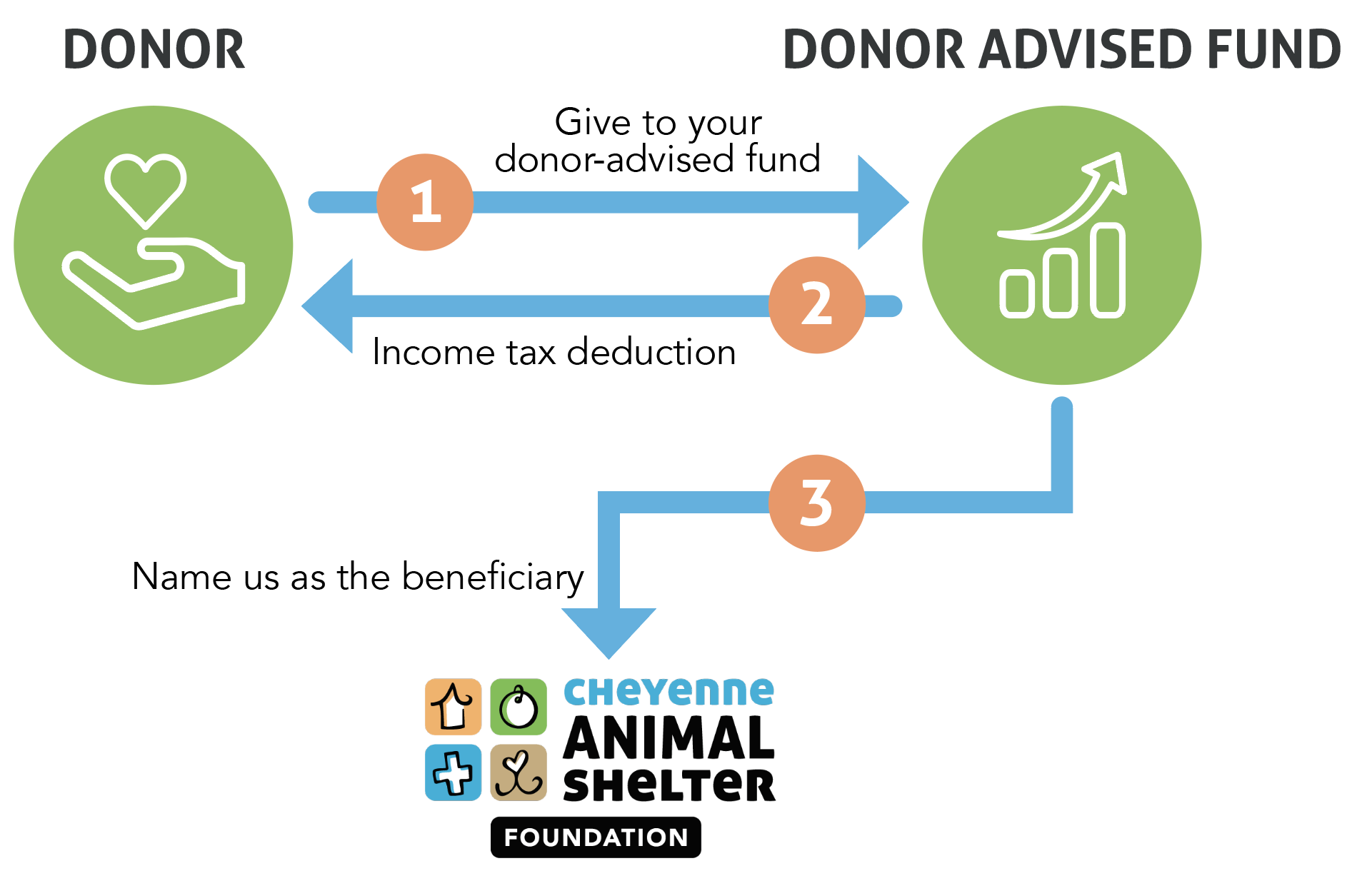

Donor Advised Funds

If you have a donor advised fund, name the Cheyenne Animal Shelter Foundation as a beneficiary. Upon the termination of the fund, the Foundation receives the remaining balance. You can also make grants to the Foundation during your lifetime from your donor advised fund.

In addition to providing financial support to the Foundation, donor-advised funds may yield immediate income tax deductions and potentially reduce capital gains and estate taxes.

Retirement Funds

Name or designate the Cheyenne Animal Shelter Foundation as a beneficiary of your IRA, 401(k), 403(b), pension, or other qualified retirement plan. Doing this does not require altering your will or trust and can typically be completed with a simple form. If your circumstances or wishes change in the future, you can modify the beneficiary designation at any time at no cost to you.

Personal Property

Donate works of art, valuable antiques, stamp and coin collections, or other “appreciated” property to the Cheyenne Animal Shelter Foundation. The Foundation will sell these items and utilize the proceeds to advance its mission. By donating personal property, you receive an immediate income tax deduction based on the appraised value of your gift. Additionally, there's no capital gains tax as long as the Foundation can utilize the gift to fulfill its mission.

Charitable Remainder Trust

A charitable remainder trust (CRT) is an irrevocable trust that generates a potential income stream for you or other beneficiaries, with the remainder of the donated assets going to the Cheyenne Animal Shelter Foundation.

There are two main types of charitable remainder trusts:

Charitable remainder annuity trusts (CRATs) distribute a fixed annuity amount annually and do not permit additional contributions.

Charitable remainder unitrusts (CRUTs) distribute a fixed percentage determined by the trust assets' balance, which are reassessed yearly. Additional contributions can be made.

Contributions made to a charitable remainder trust qualify for a partial charitable deduction for the present value of the charitable organization's remainder interest.

Mineral or Royalty Interests

Gifts of overriding royalties and royalties for minerals are ideal assets for donation.

Unfortunately, the Foundation cannot accept gifts of working or operating mineral interests because of the liability and tax consequences associated with those interests.

Qualified Charitable Distributions

Qualified Charitable Distributions allow you to gift up to $100,000 each year from your IRA to the Cheyenne Animal Shelter Foundation.

If you are 73 or older, you may be required to take a Required Minimum Distribution from your IRA. A Qualified Charitable Distribution satisfies this requirement and the amount you gift is excluded from your taxable income.

Life Insurance

Make a significant gift, even without a large estate. You can name the Cheyenne Animal Shelter Foundation as the primary or secondary beneficiary of all or a portion of your life insurance policies. Alternatively, you can transfer the ownership of fully paid insurance policies that are no longer needed to the Cheyenne Animal Shelter Foundation. By doing so, you'll be eligible for an income tax deduction equivalent to the cash surrender value of the policy.

Charitable Lead Trust

Provide the Cheyenne Animal Shelter Foundation with an annual income stream from income generating assets. A charitable lead trust is an irrevocable trust structured to provide financial support to the Cheyenne Animal Shelter Foundation for a designated period of time. When the trust expires, the remaining principal is passed to your heirs at a significantly reduced estate and gift tax rate.

Bargain Sale

Charitable bargain sales provide cash to meet your obligations or an income stream for retirement. Selling your residence or other property to the Cheyenne Animal Shelter Foundation at a price below the appraised market value gives you an immediate income tax deduction for the discount taken. Furthermore, you won't incur any capital gains tax on the donated portion of the property.

Real Estate

Gift your residence, vacation home, undeveloped land, or commercial property to the Cheyenne Animal Shelter Foundation. The Foundation may use the property or sell it and use the proceeds to further its mission. By donating real estate, you receive an income tax deduction for the fair market value of the real estate and won’t incur capital gains tax on the transfer.

Charitable Gift Annuity

Charitable gift annuities provide a way to create a legacy for animals now—and receive dependable payments for life—in exchange for a gift of cash, securities, real estate, or other property. The amount you receive throughout your lifetime is determined by the age at which you established the annuity. When the annuity terminates, the remaining residual is passed to the Cheyenne Animal Shelter Foundation.

Retained Life Estate

Your home is your biggest asset. You can even use it to make a gift while still living there. Transfer ownership of your primary residence, farm, or vacation home to the Cheyenne Animal Shelter Foundation. You can continue to reside in or use the property for your lifetime (or a specified term) while paying routine expenses like maintenance, insurance, and property taxes. This arrangement provides an immediate income tax deduction, simplified estate administration process, and the gratification of making a substantial gift that will benefit the Cheyenne Animal Shelter Foundation.

The gift planning information presented on this webpage is not offered as legal or tax advice. You will want to work with an estate planning attorney or other financial professional to ensure you make the right choices for your circumstances.

Gift Acceptance Policy

The Cheyenne Animal Shelter Foundation solicits and accepts gifts that are consistent with its mission.

Donations will generally be accepted from individuals, partnerships, corporations, foundations, government agencies, or other entities without limitations.

In the course of its regular fundraising activities, the Cheyenne Animal Shelter Foundation will accept donations of money, real property, personal property, stock, and in-kind services.

Certain types of gifts must be reviewed prior to acceptance due to the special liabilities they may pose for the Cheyenne Animal Shelter Foundation.

The Cheyenne Animal Shelter Foundation will not accept gifts that (a) would result in the Cheyenne Animal Shelter Foundation violating its corporate charter; (b) would result in the Cheyenne Animal Shelter Foundation losing its status as a 501(c)(3) not-for-profit organization; (c) are too difficult or too expensive to administer in relation to their value; (d) would result in any unacceptable consequences for the Cheyenne Animal Shelter Foundation; or (e) are for purposes outside the Cheyenne Animal Shelter Foundation’s mission.

Join Our Legacy Circle

Gift commitments like these – known as legacy gifts – are extra special and greatly appreciated. Notifying us of your legacy gift commitment helps us better plan for our financial future, ensure we fund our mission for as long as is necessary, and provides you with Legacy Circle lifetime membership. To learn more about our Legacy Circle or to let us know that the Cheyenne Animal Shelter Foundation has been included in your estate plan, please click the button below.

DONOR BILL OF RIGHTS

Philanthropy is based on voluntary action for the common good. It is a tradition of giving and sharing that is primary to the quality of life. To ensure that philanthropy merits the respect and trust of the general public, and that donors and prospective donors can have full confidence in the Cheyenne Animal Shelter Foundation, we declare that all donors have these rights:

-

The Foundation’s mission and intended use of donated resources can be found on our website here.

-

The Foundation’s Board of Director’s is available here.

-

The Foundation’s IRS Form 990 is available for review here.

-

The CAS Foundation audit is conducted annually, and copies are available for inspection upon request.

-

To learn more about our acknowledgement and recognition program for donors, click here.

-

-

-

-

-

Please contact Amber Ash at 307.459.0276 or via email at aash@caswyo.org.

The Donor Bill of Rights was created by the American Association of Fund Raising Counsel (AAFRC), the Association for Healthcare Philanthropy (AHP), the Association of Fundraising Professionals (AFP), and the Council for Advancement and Support of Education (CASE) and has been modified for the Cheyenne Animal Shelter Foundation’s purposes.

Get In Touch

Planning your estate and legacy for future generations including your charitable interests takes careful evaluation. Discussing your charitable intentions with us can lead to a much better result than going it alone. To learn more about becoming a Legacy Circle member and your options for giving, please contact:

Britney Tennant, CEO

307-632-6655 ext. 101 or (307) 222-6353